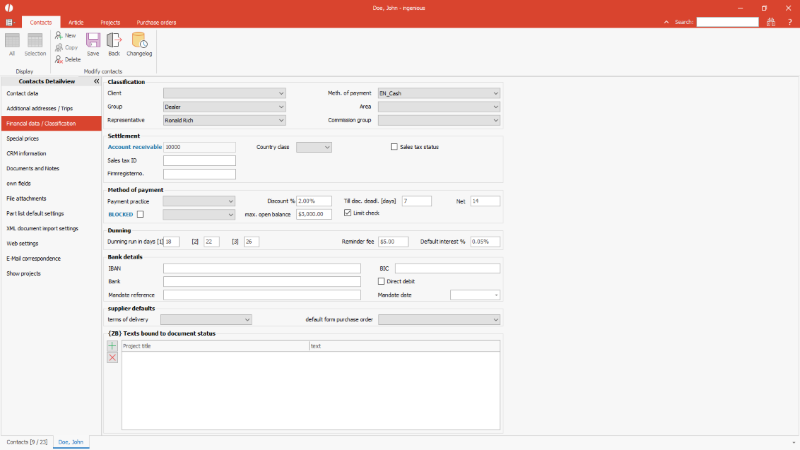

Under the navigation point "Financial data and classification" acounting details of the contact are stored and the classification of the contact to various groups is done.

Financial data / classification of a contact |

The following fields are available:

| Client | Selection list | Selection of a client e.g. for different district offices | ||||||

| Group | Selection list | Selection of an individual customer group, e.g. private customers, business customers,... Individual customer groups can be defined in global settings. | ||||||

| Representative | Selection list | Selection of the representative that attend to the customer. Representatives can be defined in global settings. | ||||||

| Method of payment | Selection list | Selection of the method of payment Method of payments can be defined in global settings. | ||||||

| Area | Selection list | Selection of an individual defined area Areas can be defined in global settings. | ||||||

| Commission group | Selection list | Classification to a commission group for calculation and reports Commission groups can be defined in global settings. | ||||||

| Account receivable | Protected input field | The account receivable is relevant for individual interfaces to accounting software. The account receivable can be initialized with the customer number. This has to be configured in the global settings. | ||||||

| Country class | Selection list |

Predfined selection for the calculation of sales taxes in project documents and for allocation of the sales account for accounting.

| ||||||

| Sales tax status | Checkbox | Definition of sales tax liability of the customer | ||||||

| Sales tax ID | Simple input field | Entry of the sales tax ID of the company | ||||||

| Firmregisterno. | Simple input field | Entry of the firm register number of the company | ||||||

| Payment practice | Selection list |

Predefined selection to rate the payment practice of the customer

| ||||||

| max. open balance | Simple input field | For customers with bad payment practice a maximum open balance can be defined. Together with the checkbox limit check the open balance is validated when a new project document is created. | ||||||

| Limit check | Checkbox | When limit check is activated the open balance is checked for that customer when a new project document is created. If the open balance is higher than the defined maximum open balance a warning is shown. | ||||||

| Discount % | Simple input field | Percentage rate that the customer can reduce an invoice by when paying before the discount deadline. When a new customer is created the field is predefined by the value that is configured in the global settings. | ||||||

| Till discount deadline[days] | Simple input field | Term within the customer is allowed to reduce the invoice amount by the discount. When a new customer is created the field is predefined by the value that is configured in the global settings. | ||||||

| Net payment | Simple input field | Term for payment of an invoice without disount. Net payment term has to be longer than dsicount deadline. When a new customer is created the field is predefined by the value that is configured in the global settings. | ||||||

| Dunning run in days[1] bis [3] | Simple input fields | Terms when unpaid invoices are included to the automatic dunning run. Term for first reminder must be longer than net payment term, terms for following reminders must be longer than the previus dunning level. When a new customer is created the fields are predefined by the values that are configured in the global settings. | ||||||

| Reminder fee | Simple input field | Amount of the fee that is calculated in a lump-sum starting with the second reminder. When a new customer is created the field is predefined by the value that is configured in the global settings. | ||||||

| Default interest % | Simple input field | Percentage rate of the default interest that is calculated starting with the second reminder. When a new customer is created the field is predefined by the value that is configured in the global settings. | ||||||

| IBAN | Simple input field | The international bank account number is mostly relevant for SEPA export. | ||||||

| BIC | Simple input field | International code of the bank | ||||||

| Bank | Simple input field | Name of the bank | ||||||

| Direct debit | Checkbox | Checkbox for configuration, whether invoices has to be paid by direct debit for grouping, filtering, searching, printing and for individual reports | ||||||

| Mandat reference | Simple input field | When module SEPA export is used for direct debits, a mandate reference number is mandatory. When selecting a payment term for the customer that is configured for SEPA in the global settings, the mandate reference number is set automatically. | ||||||

| Terms of delivery | Selection list | Individual defined terms of delivery of a supplier | ||||||

| Default form purchase order | Selection list | If a supplier request to use his special order form for purchase orders, an individual project template can be created in the text template administration. This template can be selected as default for the contact. | ||||||

| Texts bound to document status | Special text box | For each project type (quote, order confirmation, delivery note, invoice and credit notes) predfined texts can be stored that need to be printed to the related document, e.g. payment terms. The text bound to document status can be inserted to the template by field special_offer_text. |